Since Bitcon emerged in 2008, its innovative support technology known as Blockchain has been in vogue as an alternative application for business due to its main benefits: traceability, automation, transparency, immutability and real time properties.

Blockchain technology benefits

These advantages and benefits fit perfectly with the tasks entrusted to CFOs, and therefore finance is expected to be an area where blockchain will have a greater development potential:

- Management of high volume of transactions and complex processes, with a wide variety of participants, both internal and external

- Guarantee the origin and quality of the information to meet the information needs of stakeholders and the regulator.

- Real time monitoring of company KPIs, allowing the projection of future scenarios and prescribing corrective actions.

There are already real applications of blockchain in financial processes (such as in utilities companies for the management of intercompany loans) looking to learn, test and validate the new technology.

In everis we have developed a framework identifying the most suitable financial processes to applicate blockchain, but based in our experience, to take advantage of the whole potential of the new technology, the optimal approach is finding transactional environments where blockchain can act as a support base for a different number of processes integrating different technologies, and therefore providing the new environment with the benefits of a distributed system and achieving a greater impact on the business.

Considering this new approach, intercompany operations in large multinationals emerge as an optimal environment, due to its high transactional volume and its processes features.

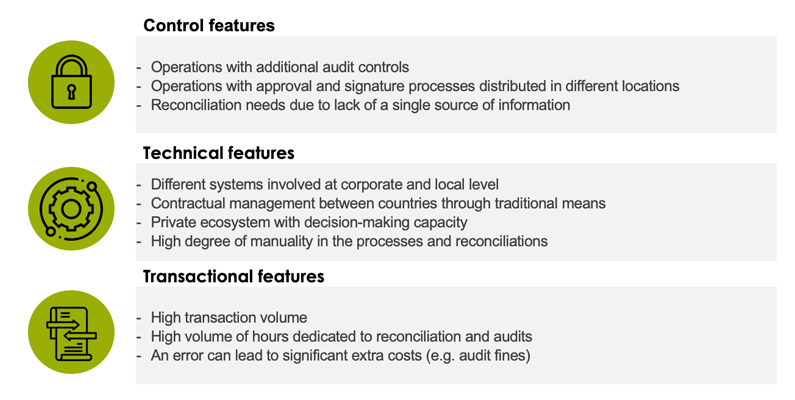

Intercompany operations features

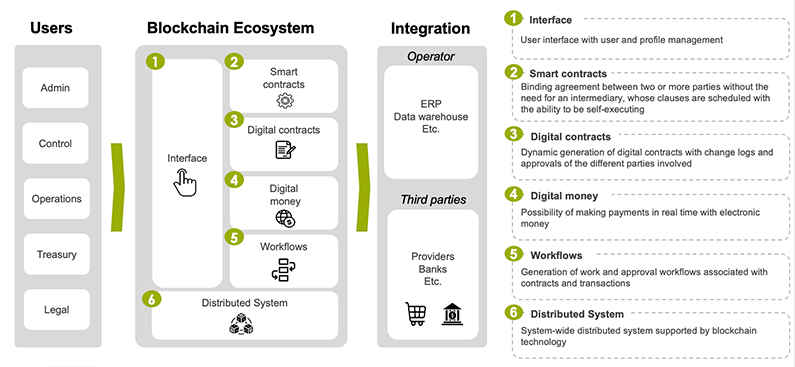

High-level approach to Blockchain ecosystem

After analyzing the different identified processes, two of them were selected to carry out a proof of concept, brand & management fees and roaming. The savings calculated from the implementation of the new blockchain environment in the proof of concept represents an ~22% of the total costs, with a payback of 1.5 years of the initial investment, achieving a direct impact on the company’s income statement beyond the qualitative benefits that allow the finance department to provide a better service.

CFOs must keep blockchain technology in mind as a differential tool that, in addition to making their work more efficient through automation, can provide them with new capabilities to give a higher quality service based on traceability, immutability and instantaneous information. It is the task of CFOs to find new areas of application with relevant business impact. In addition to intercompany operations, everis’ digital finance innovation lab has identified the following areas as potentially suitable for its application:

- Order-to-cash and procure-to-pay integration

- Revenue cycle management

- Trade finance

- Working capital and cash management

- Fraud and risk detection

- Capital planning and performance management